Knowledgenet's Printable Resources

Baseball Field Template Printable

Discover the best templates that you can edit in just. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. A baseball lineup template is a template used to create the lineup of players for a team baseball in a convenient,.

Read morePrintable Goosebumps Coloring Pages

Download and print these goosebumps coloring pages for free. Web click on the coloring page to open in a new window and print. The pictures are available without any

Read morePrintable General Ledger Sheet

Web included on this page, you'll find a simple general ledger template, a printable general ledger template, an accounting general ledger template, and a small. Web people can use several.

Read moreOcean Diorama Background Printable

Web easy ocean diorama craft project for kids | rainy day activity | ocean diorama background printable | montessori ocean activities mrmintzcrafts star seller. Web preschool printables | easy ocean.

Read moreDaycare Printable Diaper Change Log

Our printable baby care log templates are easy to use and track everything from feedings to diaper changes. Web this log is perfect for new moms, nannies, babysitters or home daycares. Web use this free printable baby care log to track all the details for your newborn including feeding, diaper change, sleep schedule, and more!

Read moreCongrats Grad Card Printable

4,886 88 52 black mortarboard graduation card. Web free printable congratulations cards, create and print your own free printable congratulations cards at home You are invited to the graduation party.

Read moreFree Vintage Sheet Music Printables

Fast shippingread ratings & reviewsshop our huge selectionshop best sellers Web download four free vintage christmas sheet music printables. Web here is a vintage sheet music graphic with a song.

Read morePrincess Belle Printable Coloring Pages

Became a princess by marrying him. Printable princess belle coloring pages are a fun way for kids of all. Web belle coloring page.

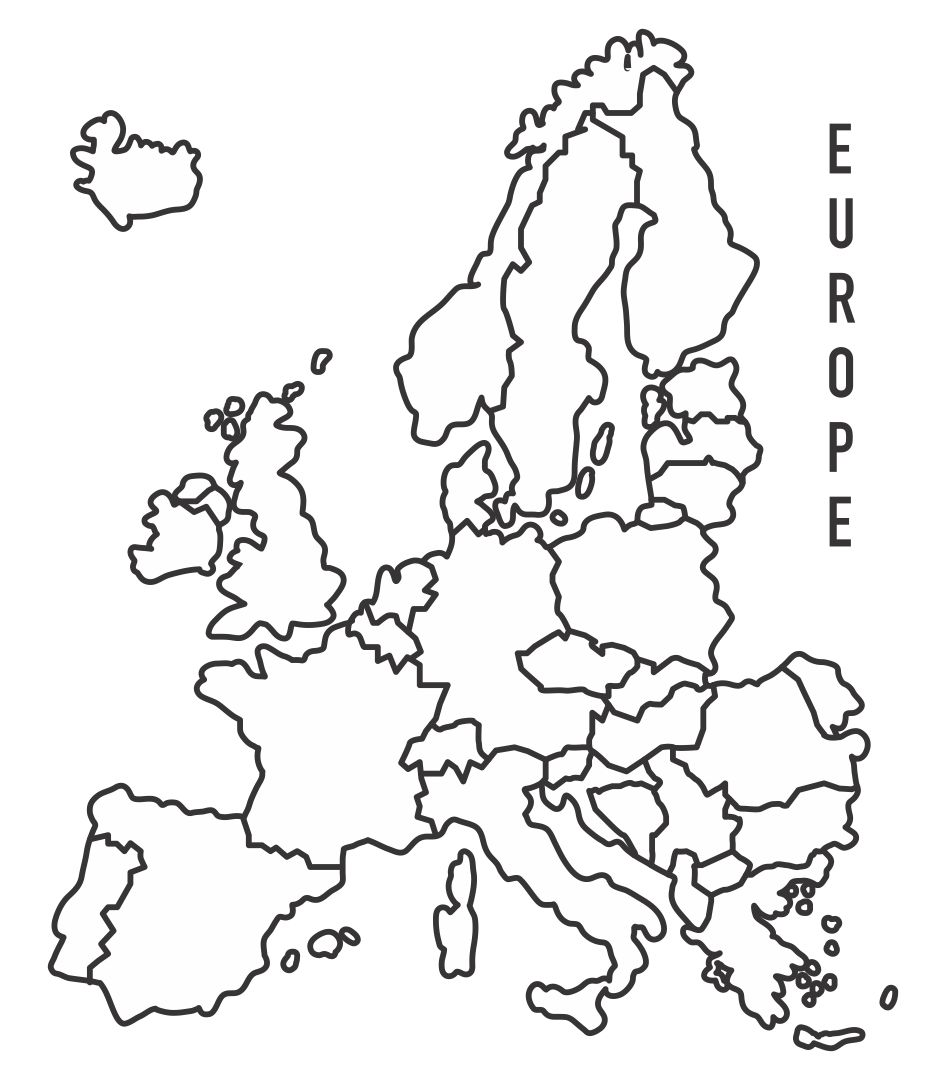

Read morePrintable Black And White Map Of Europe

Pdf, jpeg europe's capitals and major cities format: Prints in black and white. Great for reference or to print and color and learn.

Read moreFree Earth Day Printable

There’s a scavenger hunt, word search, maze and even an earth day pledge. Save the whale coloring page for earth day. Web earth day is celebrated on april 22nd each.

Read more